Written by: Marcus Noel

Sales Representative / Investor

Can you believe it’s already June?! I hope you all had a great May and that you are enjoying the warmer weather that we’ve been getting. I had the opportunity to take my dog Queso to the cottage a couple of times last month and he has absolutely been loving it! He loves getting to swim in the lake and soaking up all the sun. I'm really looking forward to taking him to the cottage more this summer!

Just like June has been heating up, so has Ottawa’s real estate market! Throughout this newsletter, we will take a deep dive into the most up-to-date real estate stats and market shifts, share valuable mortgage insights courtesy of our friend Paul over at Paul Stevenson Mortgages, as well as offer summer-ready tips and tricks for prospective buyers and sellers!

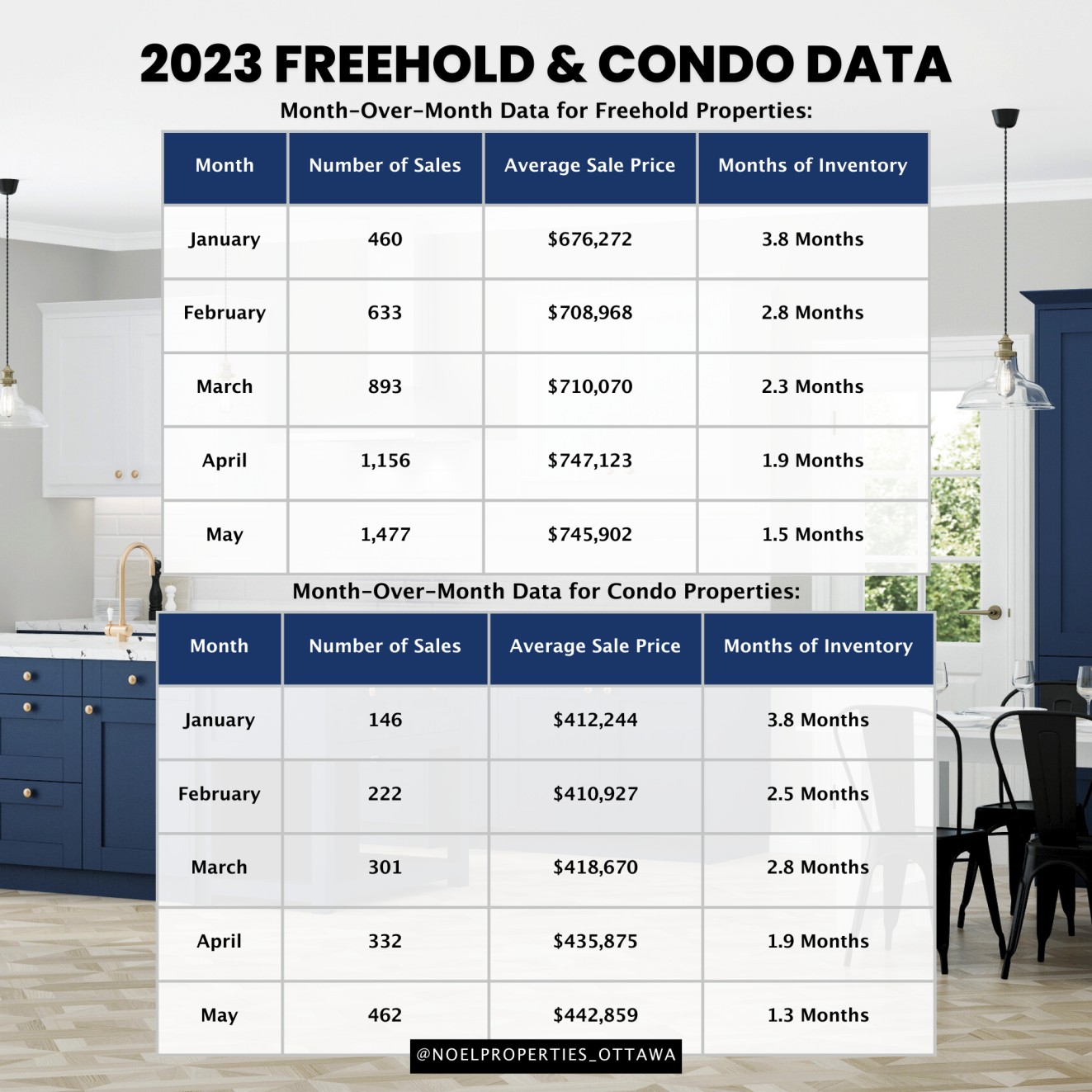

May is typically the highest-selling month and this May was no exception. In May, members of the Ottawa Real Estate Board (OREB) sold 1,939 residential properties through the Boards MLS System, which represents a 6% increase over May 2022 when 1,830 properties were sold. May’s sales included 1,477 in the freehold class and 462 in the condominium class, an increase of 8% and 1% respectively over May 2022. The five-year average for total unit sales in May was 1,961.

The average sale price for freehold properties was $745,902, which is on par with April 2023 prices; meanwhile, the average sale price for condos was $442,859, representing a 2% gain over April 2023. When comparing May’s average sale prices to the beginning of this year, the average sale price of freehold and condo properties has increased by a WHOPPING 10% and 7% respectively! Year-to-date average sale prices are at $727,728 for freeholds and $428,394 for condos. Furthermore, days on market (DOM) has decreased from 27 to 23 days for freehold properties and from 33 to 26 days for condos.

According to Ken Dekker, the Ottawa Real Estate Board President, in May “we saw the first year-over-year unit sales volume increase since February 2022.” Ken further states that he believes that 2023 will be a “promising year for sellers, barring any interest rate adjustments.”

Throughout May, we saw 2,822 new listings, which is an increase of 32% from April 2023. Despite the increase in new listings, we’re sitting at 1.5 months of inventory for freehold properties and 1.3 months of inventory for condos. As stated by Ken Dekker, “With only five to six weeks of inventory, we are in a strong seller’s market. With the pent-up high demand and sales volume increasing, we are likely to see upward pressure on prices as demand continues to outstrip supply.” With average prices slightly down from last month, prospective buyers should consider entering the market sooner rather than later, as prices are expected to increase in the latter half of 2023.

Be sure to check out the tables below that show month-over-month data for both freehold and condominium properties.

As a result of the lower housing inventory, multiple offers are becoming a reality again in some neighbourhoods. Working with a realtor who has up-to-the-minute market data is key. As always, if you have any questions regarding the real estate market or if you, your family, or your friends are thinking of making a real estate move, I would love the opportunity to help you navigate this evolving competitive resale market.

Thank you for reading!

Marcus Noel